Introduction

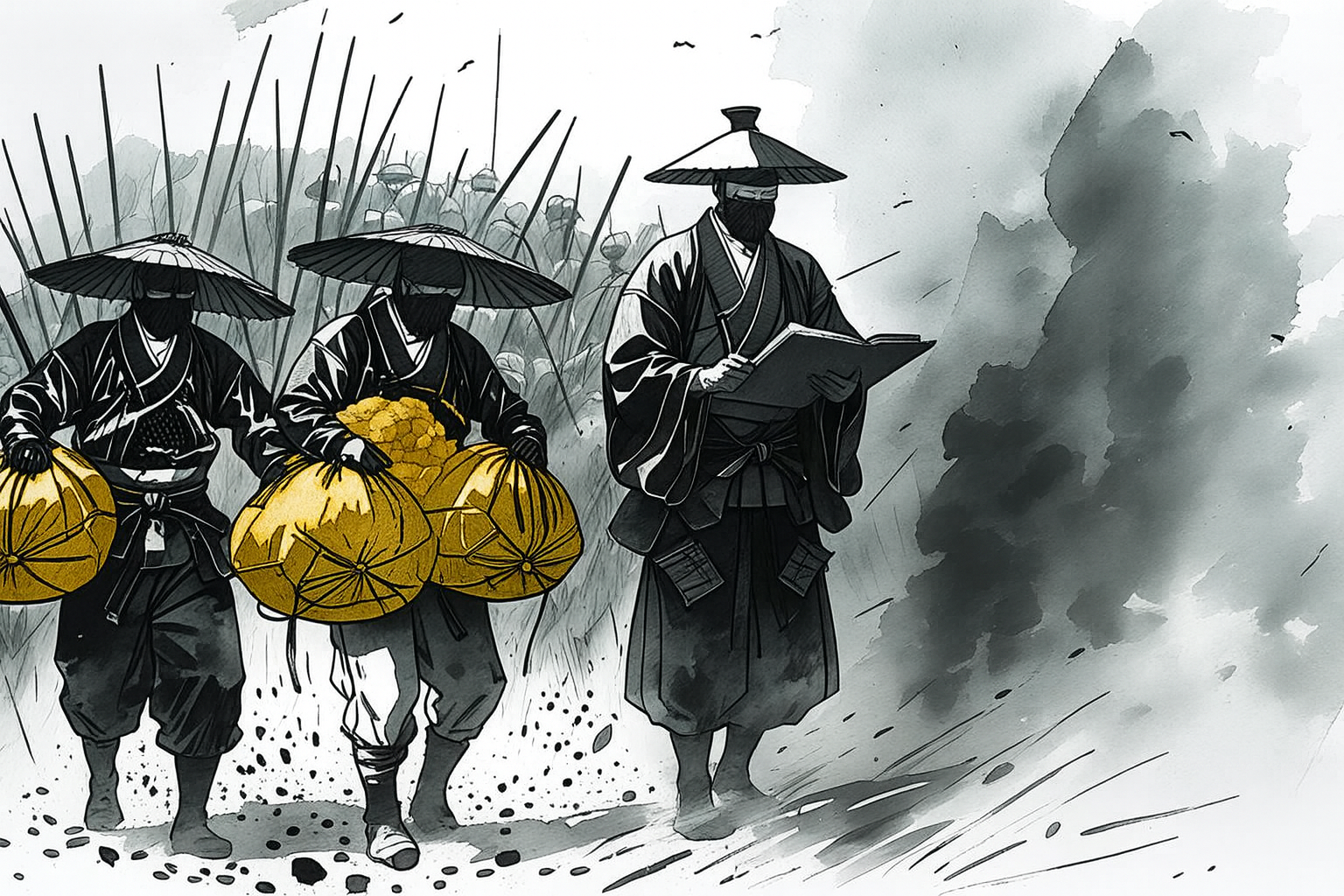

In Edo-period Japan, farmers paid their taxes not in cash, but in rice. The amount was often 40–50% of the harvest, a heavy burden that tied wealth directly to the land and the seasons. When famine struck, communities had to adapt—reducing consumption, storing grain, or seeking relief from lords. These strategies were about survival, planning, and efficiency.

Today, we face different challenges, but the principle remains: how you manage resources, and how much you keep after obligations, determines long-term prosperity. For modern investors in the United States, this means practicing tax-efficient investing.

Edo-Era Taxes and Survival

- Tax in Rice: Wealth was measured and collected in koku (one koku = enough rice to feed one person for a year). Farmers gave up a significant share of their crop.

- Community Resilience: In times of famine, some domains lowered taxes temporarily or distributed stored rice. Wise lords prepared granaries for emergencies, just as wise families saved for hard times.

- Lesson: What matters is not just how much you produce, but how much you keep and preserve.

Modern Parallel: Tax-Efficient Investing in the U.S.

Just as Edo farmers sought to maximize what remained after taxes, investors today must think about after-tax returns, not just gross returns.

Key Strategies

- Use Tax-Advantaged Accounts

- 401(k), IRA, Roth IRA: These accounts shelter growth from immediate taxation. Contributions and withdrawals are treated differently, so choose based on your current vs. future tax bracket.

- Favor Long-Term Capital Gains

- Investments held over one year are taxed at lower rates than short-term gains. Patience can save thousands in taxes.

- Tax-Loss Harvesting

- Selling losing investments to offset gains can reduce taxable income. Similar to how farmers stored rice in good years to prepare for lean years.

- Municipal Bonds

- Interest from many municipal bonds is exempt from federal taxes, and sometimes state taxes. This is like a domain offering relief from heavy obligations.

Samurai Wisdom for Investors

The samurai class valued discipline, foresight, and frugality. Edo farmers survived by planning for famine and making the most of what remained after tax. Likewise, today’s investors should focus not only on growing assets but also on minimizing tax drag.

In both eras, true wealth is measured not by what you earn, but by what you keep.

Conclusion

From rice fields of Edo Japan to Wall Street portfolios, the principle is timeless:

- Plan ahead for uncertainty

- Preserve your gains through smart strategy

- Respect efficiency in both life and finance

Tax-efficient investing is the modern way to apply this samurai wisdom.

Follow us on X for daily Samurai & Personal Finance insights → @zenfinance1101

Comments